When you retire — whether at 65 or later — you’ll have a choice in health plans: Original Medicare (Part A and Part B) by itself, a Medicare Supplement plan or enroll in a Medicare Advantage (Part C) plan. Since it’s such an important decision, you should compare your options to learn about the advantages of a Medicare Advantage plan and why it’s the preference for over 24 million people projected to enroll for 2020.1

What’s the difference between Medicare coverage options?

Original Medicare is a good coverage option from the federal government, but it only pays for part of your healthcare expenses — about 80%, in fact. The rest is your responsibility, and if you’re hospitalized, you could owe thousands out of your own pocket. A Medicare Supplement plan can help you cover the costs that Original Medicare doesn’t, but the monthly premiums can be quite expensive. A Medicare Advantage plan, on the other hand, offers you an affordable, all-in-one solution that helps protect your health as well as your wallet.

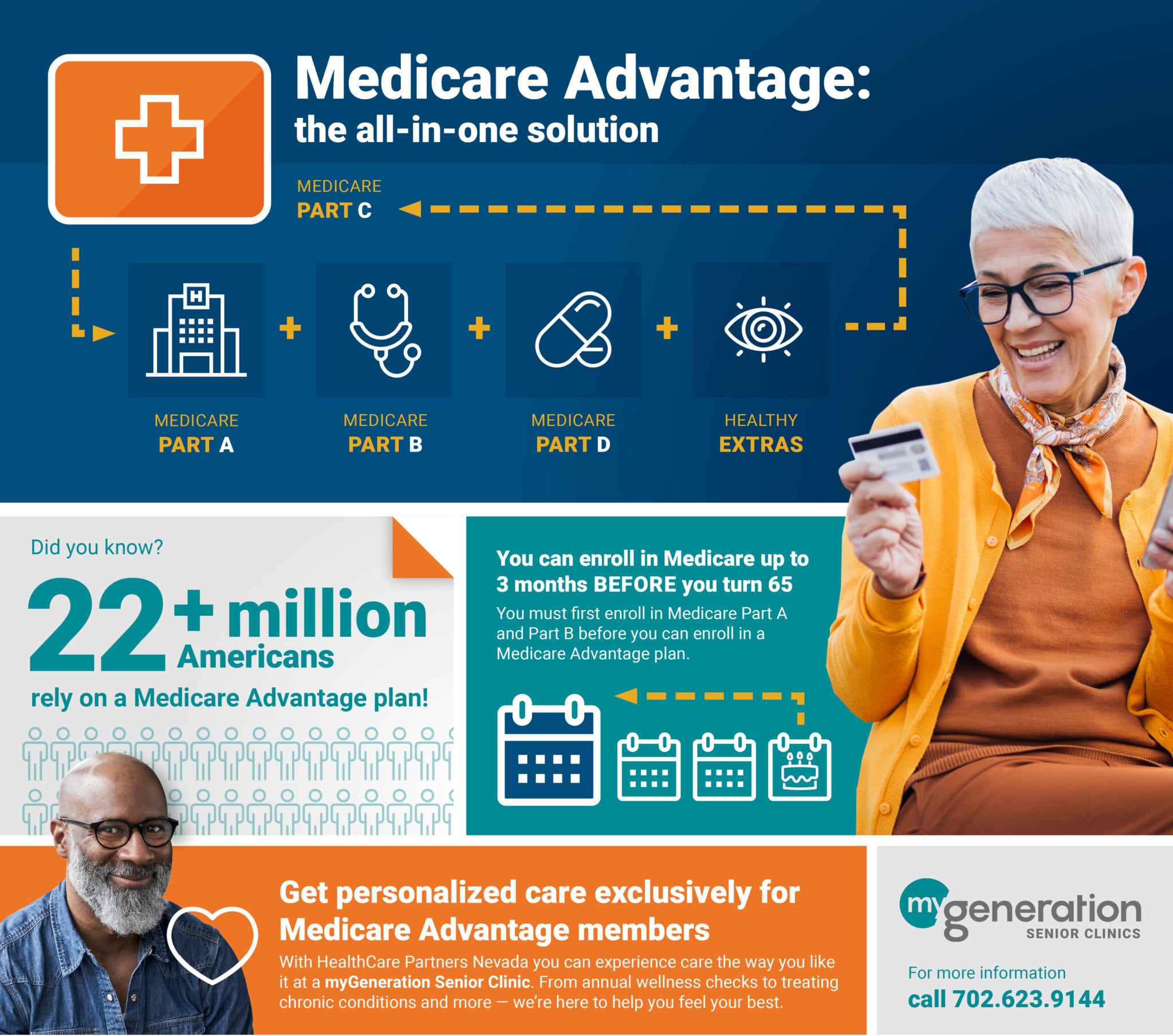

All-in-one plans are all about quality, cost-savings and convenience.

Like Original Medicare and Medicare Supplements, Medicare Advantage plans include coverage for your preventive healthcare, as well as routine and major care. But, unlike those two options, many Medicare Advantage plans also have built-in Medicare Part D prescription drug coverage, along with extra benefits such as dental, vision, hearing, fitness, even acupuncture. With a Medicare Advantage plan, you also get emergency coverage when you travel outside Nevada.

You’ll also have just one monthly premium — no need for a separate prescription drug plan — one ID card for services, one number to call for customer service, and one benefit everybody can agree on: peace of mind. Medicare Advantage plans are also known for having affordable copays for things like doctor visits, prescription drugs, urgent care and lab work. Oftentimes, your Original Medicare Part A and Part B deductibles are fully covered, too. That can save you up to $1,606 a year.2

Note: With Original Medicare you will still be required to pay a monthly premium. For most people, Medicare Part A has no charge, but there are monthly costs for Medicare Part B ($144.60 standard premium; higher depending on income) and that’s a requirement for as long as you’re enrolled. For more details, visit Medicare.gov.

Medicare Advantage (Part C) is personal insurance from private companies — approved by Medicare.

To give you a clearer understanding about Medicare Advantage plans, you should know that private companies contract with the federal government to provide all Original Medicare Part A (hospital) and Part B (medical) benefits. Most Medicare Advantage plans also include Medicare Part D (prescription drugs). Two popular types of plans are the HMO (Health Maintenance Organization), and PPO (Preferred Provider Organization).

Can anyone enroll in a Medicare Advantage plan?

Good question! Before you can sign up for a Medicare Advantage plan, you have to be enrolled in Original Medicare. We know what you’re thinking: Why can’t I just sign up for a Medicare Advantage plan? Because private companies contract with the federal government to provide all Original Medicare Part A and Part B benefits — so you have to be enrolled in those first.

When you enroll in a Medicare Advantage plan, you’re still in the Medicare program and get all the benefits you’d receive with Original Medicare. What’s different is that the private insurance company offering your plan provides you with the healthcare benefits versus the federal government.

Eligibility highlights you should know about.

At age 65, you’re eligible for full Original Medicare benefits. If you’re already receiving benefits from Social Security or the Railroad Retirement Board (RRB), Medicare Part A and Part B automatically start the first day of the month you turn 65. If not, you have a 7-month window to enroll in Original Medicare — starting three months before your 65th birthday month, and ending three months after your birthday month. If you decide to keep working after age 65, there are different requirements to avoid paying a Medicare penalty. For more details, visit Medicare.gov.

As for Medicare Advantage plan eligibility, you must live in the plan’s service area, must be enrolled in both Original Medicare Part A and Part B and you cannot be suffering from kidney failure (End Stage Renal Disease) at the time of your enrollment.

myGeneration Senior Clinics: another advantage of being enrolled in a Medicare Advantage plan.

Not every Medicare beneficiary living in Southern Nevada gets to experience senior-focused healthcare, with physicians and care teams specializing in every aspect of your care. That’s because we only provide care to people who are enrolled in Medicare Advantage plans from Humana and UnitedHealthcare (call 702-852-9000 or click for details).

Why do we do that? Since myGeneration offers such a wide variety of healthcare services — everything from annual wellness checks to treating chronic conditions, diagnostic testing to laboratory services, immunizations and more — we want our patients to have a healthcare plan that covers it all!

To learn more about Medicare Advantage plans and myGeneration Senior Clinics, call us at 702-852-9000.

1Centers for Medicare & Medicaid Services

2Annual coverage/savings based on combined cost of 2020 Medicare Part A deductible ($1,408) and Medicare Part B deductible ($198).